Money Calendar Pro: A Comprehensive Review For 2023

Money Calendar Pro: A Comprehensive Review for 2023

Related Articles: Money Calendar Pro: A Comprehensive Review for 2023

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Money Calendar Pro: A Comprehensive Review for 2023. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Money Calendar Pro: A Comprehensive Review for 2023

- 2 Introduction

- 3 Money Calendar Pro: A Comprehensive Review for 2023

- 3.1 Unveiling the Features of Money Calendar Pro

- 3.2 Benefits of Utilizing Money Calendar Pro

- 3.3 Potential Drawbacks and Considerations

- 3.4 Frequently Asked Questions (FAQs)

- 3.5 Tips for Optimizing Money Calendar Pro Usage

- 3.6 Conclusion

- 4 Closure

Money Calendar Pro: A Comprehensive Review for 2023

In the intricate world of personal finance, achieving financial goals requires meticulous planning and consistent execution. While numerous tools and strategies exist, a robust financial calendar emerges as a vital element for success. Money Calendar Pro, a powerful financial planning software, aims to streamline the process, providing users with a comprehensive and intuitive platform to manage their finances effectively. This review delves into the features, benefits, and potential drawbacks of Money Calendar Pro, offering a comprehensive analysis for discerning individuals seeking to optimize their financial journey.

Unveiling the Features of Money Calendar Pro

Money Calendar Pro distinguishes itself through a range of features designed to simplify and enhance financial management. Here’s a detailed breakdown:

1. Comprehensive Budget Tracking:

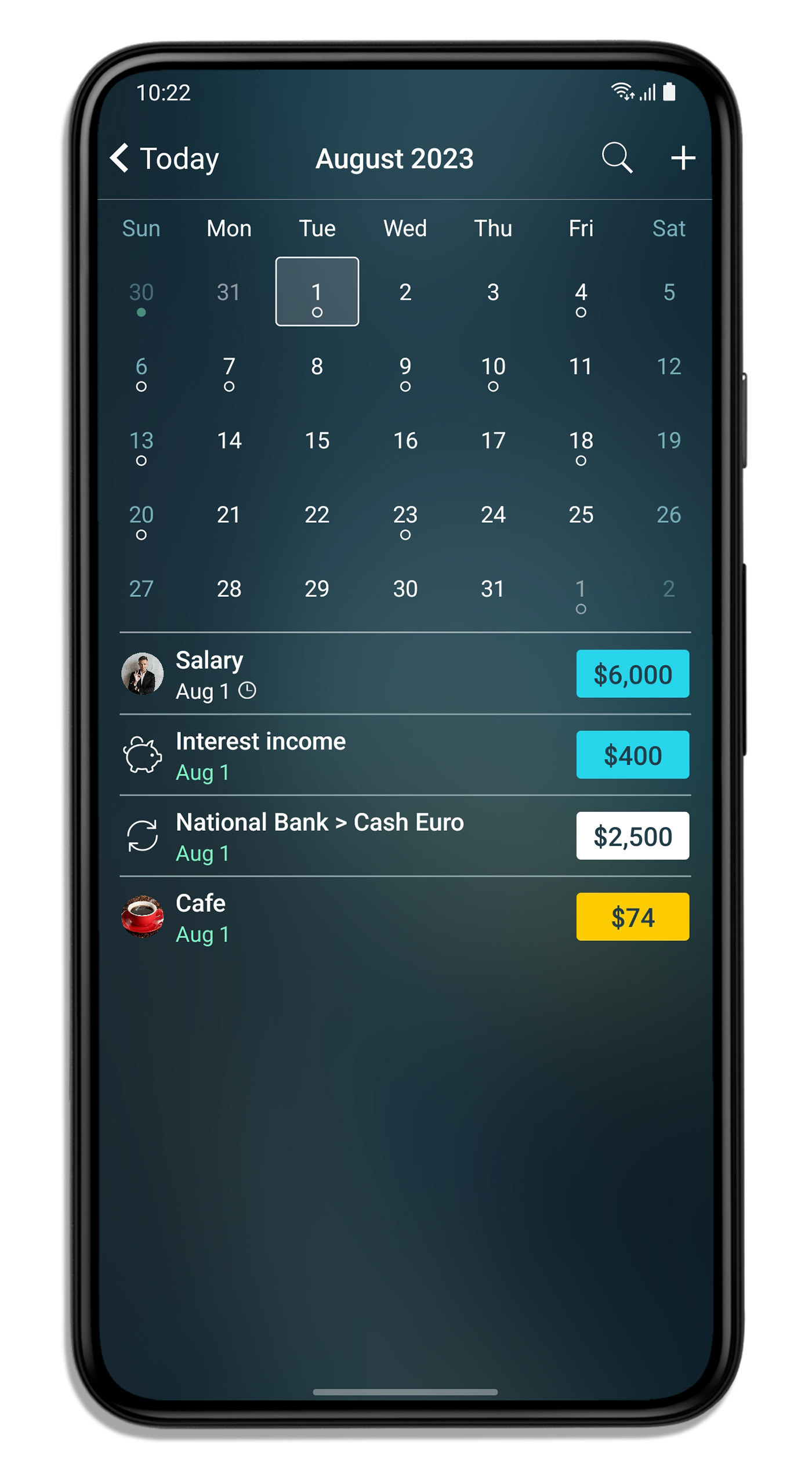

- Visual Budget Breakdown: Money Calendar Pro offers a visually appealing and easily digestible breakdown of income and expenses, allowing users to grasp their financial picture at a glance.

- Categorization and Analysis: The software enables users to categorize spending, providing valuable insights into where their money goes. This granular analysis empowers informed financial decisions.

- Goal Setting and Tracking: Users can set specific financial goals, such as saving for a down payment or a vacation, and track their progress towards achieving them. The software provides visual representations of goal progress, motivating users to stay on track.

2. Automated Bill Payment and Reminders:

- Scheduled Payments: Money Calendar Pro facilitates automated bill payments, ensuring timely payments and avoiding late fees. Users can schedule recurring payments, eliminating the need for manual reminders.

- Customizable Reminders: The software allows users to set personalized reminders for various financial tasks, such as paying bills, reviewing investments, or checking credit scores. These reminders serve as timely prompts to maintain financial discipline.

3. Investment Management:

- Portfolio Tracking: Money Calendar Pro enables users to track their investment portfolios, providing real-time updates on asset performance and overall portfolio value.

- Investment Analysis: The software offers insightful analysis of investment performance, helping users understand their portfolio’s risk and return profile.

- Goal-Based Investing: Users can align their investments with specific financial goals, ensuring that their portfolio is strategically positioned to achieve desired outcomes.

4. Debt Management:

- Debt Tracking: Money Calendar Pro allows users to track all outstanding debts, including loan balances, interest rates, and minimum payments.

- Debt Reduction Strategies: The software provides tools and strategies for debt reduction, such as debt snowball or debt avalanche methods.

- Debt-Free Planning: Users can set timelines for becoming debt-free, enabling them to visualize their progress and stay motivated.

5. Financial Reporting and Analytics:

- Personalized Reports: Money Calendar Pro generates customized financial reports, providing insights into spending patterns, investment performance, and debt reduction progress.

- Visual Data Visualization: The software presents financial data in visually appealing charts and graphs, making it easier to understand complex financial information.

- Trend Analysis: Money Calendar Pro analyzes financial trends over time, allowing users to identify areas for improvement and make informed decisions.

6. Secure Data Storage and Privacy:

- Data Encryption: Money Calendar Pro utilizes robust data encryption technology to safeguard sensitive financial information, ensuring data security and privacy.

- Multi-Factor Authentication: The software offers multi-factor authentication, adding an extra layer of security to user accounts.

Benefits of Utilizing Money Calendar Pro

Adopting Money Calendar Pro can yield substantial benefits for individuals striving for financial well-being:

1. Enhanced Financial Clarity and Control:

- Centralized Financial Hub: Money Calendar Pro consolidates all financial information in one central location, providing a comprehensive overview of income, expenses, investments, and debts.

- Real-Time Insights: The software offers real-time updates and insights into financial activity, enabling users to monitor their financial health closely.

2. Improved Budgeting and Spending Habits:

- Visual Budget Analysis: The software’s visual budget breakdown facilitates a clear understanding of spending patterns, allowing users to identify areas for improvement.

- Goal-Oriented Budgeting: By aligning budgets with specific financial goals, Money Calendar Pro promotes disciplined spending and encourages progress towards desired outcomes.

3. Streamlined Bill Payment and Debt Management:

- Automated Bill Payments: The software’s automated bill payment feature eliminates the risk of missed payments and associated penalties.

- Debt Reduction Tools: Money Calendar Pro provides effective debt management tools, empowering users to tackle debt strategically and efficiently.

4. Informed Investment Decisions:

- Portfolio Tracking and Analysis: The software’s investment tracking and analysis capabilities provide valuable insights into portfolio performance, enabling informed investment decisions.

- Goal-Based Investing: By aligning investments with specific financial goals, Money Calendar Pro helps users build a portfolio that supports their long-term financial objectives.

5. Enhanced Financial Literacy:

- Financial Education Resources: Money Calendar Pro may offer access to financial education resources, such as articles, videos, or webinars, empowering users to enhance their financial literacy.

- Data-Driven Insights: The software’s comprehensive financial reporting and analytics capabilities provide users with valuable data-driven insights, fostering a deeper understanding of their financial situation.

Potential Drawbacks and Considerations

While Money Calendar Pro offers numerous advantages, it’s essential to acknowledge potential drawbacks and consider these factors before making a decision:

1. Subscription Cost:

- Monthly or Annual Fees: Money Calendar Pro typically operates on a subscription-based model, requiring users to pay monthly or annual fees to access its features.

- Cost-Benefit Analysis: Before subscribing, users should carefully assess the value proposition and compare costs with alternative financial management tools.

2. Data Security Concerns:

- Data Breaches: Despite robust security measures, the risk of data breaches always exists. Users should carefully review the software’s security protocols and consider the potential consequences of data compromise.

- Data Privacy: Users should understand the software’s data privacy policies and ensure their personal financial information is handled responsibly.

3. User Interface and Learning Curve:

- Complexity: Some users may find the software’s interface complex or challenging to navigate, requiring time and effort to learn its functionalities.

- User-Friendliness: Ideally, the software should be user-friendly and intuitive, minimizing the learning curve and maximizing user engagement.

4. Integration with Other Financial Tools:

- Compatibility: Users should ensure that Money Calendar Pro seamlessly integrates with other financial tools they utilize, such as bank accounts, investment platforms, or credit card accounts.

- Data Synchronization: Smooth data synchronization between different financial tools is crucial for maintaining a comprehensive and accurate financial picture.

5. Limited Customization Options:

- Customization Flexibility: Some users may find the software’s customization options limited, hindering their ability to tailor the platform to their specific needs.

- Flexibility and Control: Ideally, the software should offer sufficient customization options to cater to diverse financial needs and preferences.

Frequently Asked Questions (FAQs)

Q: Is Money Calendar Pro suitable for beginners?

A: While Money Calendar Pro can be beneficial for both beginners and experienced users, its features and functionalities may be overwhelming for those new to personal finance management. Beginners may benefit from starting with simpler budgeting tools and gradually transitioning to more comprehensive platforms like Money Calendar Pro.

Q: Can I access Money Calendar Pro on multiple devices?

A: Many financial management software platforms, including Money Calendar Pro, offer multi-device access, allowing users to manage their finances from smartphones, tablets, and computers. However, it’s essential to check the specific features and functionalities available on each device.

Q: How secure is Money Calendar Pro?

A: Reputable financial management software providers prioritize data security and employ robust encryption technologies and multi-factor authentication to protect user data. However, it’s crucial to conduct thorough research and review the software’s security protocols before entrusting sensitive financial information.

Q: What is the cost of Money Calendar Pro?

A: The cost of Money Calendar Pro varies depending on the subscription plan chosen. It’s essential to compare different subscription options and consider the value proposition before making a decision.

Q: Does Money Calendar Pro offer customer support?

A: Most financial management software platforms provide customer support channels, such as email, phone, or live chat, to assist users with any questions or issues. It’s essential to verify the availability and responsiveness of customer support before subscribing.

Tips for Optimizing Money Calendar Pro Usage

- Set Clear Financial Goals: Define specific, measurable, achievable, relevant, and time-bound (SMART) financial goals to guide your financial planning and track progress.

- Categorize Expenses Meticulously: Accurately categorize expenses to gain valuable insights into spending patterns and identify areas for improvement.

- Regularly Review and Adjust Budgets: Periodically review and adjust budgets based on changes in income, expenses, or financial goals.

- Utilize Automated Bill Payment Features: Leverage automated bill payment functionalities to ensure timely payments and avoid late fees.

- Track Debt Reduction Progress: Monitor debt reduction progress closely and celebrate milestones to maintain motivation.

- Leverage Financial Reporting and Analytics: Utilize the software’s reporting and analytics features to gain insights into financial trends and make informed decisions.

- Explore Integration Options: Explore integration possibilities with other financial tools to streamline financial management and enhance data accuracy.

Conclusion

Money Calendar Pro presents a compelling solution for individuals seeking to enhance their financial management capabilities. Its comprehensive features, including budget tracking, bill payment automation, investment management, and debt reduction tools, empower users to gain control over their finances and achieve their financial goals. However, it’s essential to carefully consider the potential drawbacks, such as subscription costs, data security concerns, and user interface complexity, before making a decision. By conducting thorough research, comparing options, and utilizing the software effectively, individuals can leverage Money Calendar Pro to embark on a journey towards financial success.

![Money Calendar Pro - Scam or Legit? [Reviews]](https://nobsimreviews.com/wp-content/uploads/2019/09/Snip20190918_37.png)

Closure

Thus, we hope this article has provided valuable insights into Money Calendar Pro: A Comprehensive Review for 2023. We thank you for taking the time to read this article. See you in our next article!