Navigating The Economic Landscape: Understanding The Power Of The Forex Factory Economic Calendar

Navigating the Economic Landscape: Understanding the Power of the Forex Factory Economic Calendar

Related Articles: Navigating the Economic Landscape: Understanding the Power of the Forex Factory Economic Calendar

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Economic Landscape: Understanding the Power of the Forex Factory Economic Calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Economic Landscape: Understanding the Power of the Forex Factory Economic Calendar

In the dynamic world of forex trading, where currency values fluctuate constantly, understanding the underlying economic forces driving these changes is paramount. This is where the Forex Factory Economic Calendar emerges as an invaluable tool, providing traders with a comprehensive overview of upcoming economic events and their potential impact on market sentiment.

Decoding the Economic Calendar: A Window into Market Movers

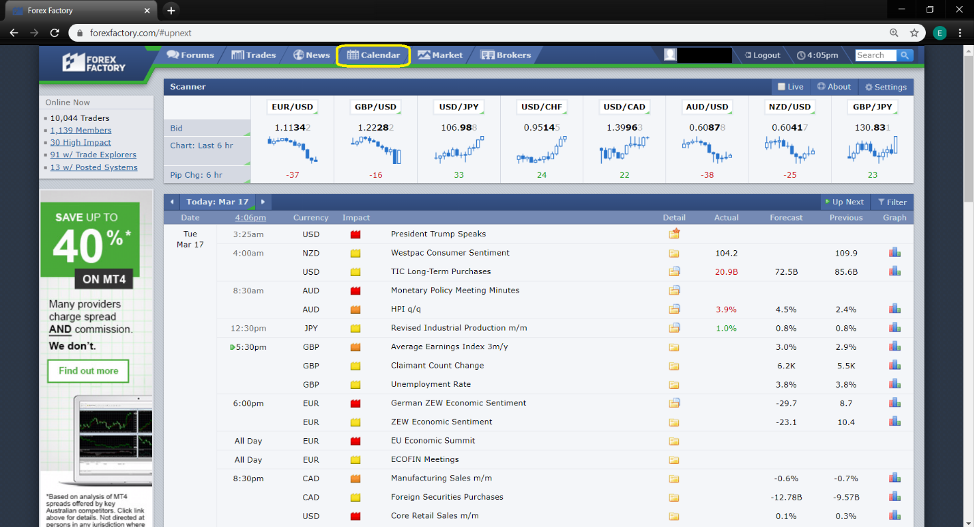

The Forex Factory Economic Calendar functions as a central hub for economic data releases, presenting a meticulously curated schedule of events across various countries and regions. This data encompasses a wide range of economic indicators, including:

- Central Bank Interest Rate Decisions: These announcements, often accompanied by press conferences, reveal the monetary policy stance of a central bank and its implications for currency values.

- Gross Domestic Product (GDP) Growth: A key indicator of a country’s economic health, GDP growth figures reveal the overall output of goods and services.

- Inflation Rates: These figures measure the rate at which prices are rising, offering insights into consumer spending and potential policy responses.

- Unemployment Rates: This indicator reflects the percentage of the labor force that is unemployed, providing insights into the strength of the job market.

- Trade Balances: This data shows the difference between a country’s exports and imports, offering insights into its economic competitiveness and global demand for its goods and services.

- Consumer Confidence Indices: These surveys gauge the sentiment of consumers about the economy, providing a forward-looking indicator of potential spending patterns.

Beyond the Data: Understanding Impact and Volatility

The Economic Calendar’s true value lies not just in providing data but in helping traders interpret its significance. Each event is accompanied by:

- Importance Rating: This rating reflects the potential market impact of the event, ranging from low to high. High-impact events are more likely to cause significant currency fluctuations.

- Previous Release: This information allows traders to compare the latest data release to prior figures and identify potential trends.

- Forecast: The calendar provides consensus forecasts from analysts, offering insights into market expectations and potential surprises.

- Actual Release: Once the data is released, the calendar updates with the actual figure, allowing traders to assess the market reaction in real-time.

Harnessing the Power of the Economic Calendar: Practical Applications for Traders

The Forex Factory Economic Calendar empowers traders in several ways:

- Informed Trading Decisions: By understanding the potential impact of upcoming events, traders can adjust their strategies and positions accordingly, mitigating risks and maximizing potential gains.

- Identifying Trading Opportunities: The calendar highlights events that are likely to create volatility, allowing traders to capitalize on these market movements.

- Understanding Market Sentiment: The calendar provides insights into how market participants are reacting to economic news, helping traders gauge the overall sentiment and adjust their strategies accordingly.

- Risk Management: By anticipating potential market fluctuations, traders can manage their risk more effectively, setting appropriate stop-loss orders and adjusting their position sizes.

Beyond the Basics: Advanced Features and Customization

The Forex Factory Economic Calendar goes beyond basic functionality, offering a range of advanced features:

- Customizable Filters: Traders can tailor their view by filtering events based on country, currency pair, importance rating, and release time.

- Calendar Alerts: Users can set up alerts for specific events, ensuring they don’t miss important releases.

- Economic Calendar News: The calendar provides links to news articles related to each event, offering further context and analysis.

- Historical Data: Access to historical data allows traders to analyze past trends and identify recurring patterns.

FAQs: Addressing Common Questions about the Economic Calendar

1. Is the Economic Calendar Free to Use?

Yes, the Forex Factory Economic Calendar is a free resource available to all users.

2. How Accurate are the Forecasts Provided?

While forecasts are based on analyst consensus, they are not guaranteed to be accurate. Economic data is subject to various factors and can be unpredictable.

3. How Often is the Calendar Updated?

The calendar is updated in real-time, ensuring traders have access to the latest information.

4. What is the Best Way to Use the Economic Calendar?

The most effective approach is to use the calendar in conjunction with other technical and fundamental analysis tools. It should be considered a part of a broader trading strategy.

5. Can I Use the Calendar to Predict Future Market Movements?

While the calendar provides insights into potential market reactions, it is not a crystal ball. Economic events can have complex and unpredictable impacts on currency values.

Tips for Effective Utilization of the Economic Calendar

- Focus on High-Impact Events: Prioritize events with a high importance rating, as they are more likely to cause significant market fluctuations.

- Analyze Historical Data: Study past releases of key economic indicators to identify patterns and potential trends.

- Consider Market Sentiment: Pay attention to how the market is reacting to news releases, as sentiment can influence currency movements.

- Manage Risk: Use stop-loss orders and adjust position sizes to mitigate potential losses during periods of increased volatility.

- Stay Informed: Keep abreast of economic news and events, as unexpected developments can impact market sentiment and currency values.

Conclusion: A Powerful Tool for Informed Forex Trading

The Forex Factory Economic Calendar is an indispensable tool for forex traders, providing a comprehensive overview of economic events and their potential impact on currency markets. By leveraging the information it provides, traders can make more informed decisions, identify trading opportunities, and manage their risk effectively. While it is not a guaranteed path to success, the Economic Calendar empowers traders with valuable insights, helping them navigate the complex and dynamic world of forex trading.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Economic Landscape: Understanding the Power of the Forex Factory Economic Calendar. We appreciate your attention to our article. See you in our next article!