Navigating The Market With Earnings Reports: A Guide To Understanding And Utilizing Earnings Calendars

Navigating the Market with Earnings Reports: A Guide to Understanding and Utilizing Earnings Calendars

Related Articles: Navigating the Market with Earnings Reports: A Guide to Understanding and Utilizing Earnings Calendars

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Market with Earnings Reports: A Guide to Understanding and Utilizing Earnings Calendars. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Navigating the Market with Earnings Reports: A Guide to Understanding and Utilizing Earnings Calendars

- 2 Introduction

- 3 Navigating the Market with Earnings Reports: A Guide to Understanding and Utilizing Earnings Calendars

- 4 The Importance of Earnings Calendars

- 5 Types of Earnings Calendars

- 6 How to Use an Earnings Calendar Effectively

- 7 FAQs About Earnings Calendars

- 8 Tips for Utilizing Earnings Calendars

- 9 Conclusion

- 10 Closure

Navigating the Market with Earnings Reports: A Guide to Understanding and Utilizing Earnings Calendars

The stock market is a dynamic landscape, constantly shifting based on a multitude of factors. One of the most significant influences on stock prices is the release of corporate earnings reports. These reports provide a snapshot of a company’s financial health, revealing its profitability, revenue, and future outlook. For investors, understanding and utilizing these reports is crucial for making informed investment decisions.

This is where earnings calendars come into play. These calendars provide a comprehensive overview of when publicly traded companies are expected to release their earnings reports. By tracking these dates, investors can stay ahead of the curve, anticipating potential market volatility and strategizing their investment approach.

The Importance of Earnings Calendars

Earnings calendars offer several key benefits for investors:

1. Informed Decision-Making: By knowing when a company is set to release its earnings, investors can prepare for potential price fluctuations. This allows them to adjust their positions accordingly, potentially capitalizing on opportunities or mitigating risks.

2. Identifying Market Trends: Observing the earnings calendar helps investors identify broader market trends. For example, a cluster of positive earnings reports from a specific sector might indicate a bullish sentiment for that industry.

3. Understanding Company Performance: Earnings reports provide valuable insights into a company’s financial performance. Investors can analyze key metrics like revenue growth, profit margins, and debt levels to assess the company’s overall health and potential for future success.

4. Evaluating Investment Opportunities: By analyzing earnings reports and comparing them to analysts’ expectations, investors can identify undervalued or overvalued stocks. This information can guide investment decisions and help investors make informed choices.

5. Staying Ahead of the Competition: In today’s fast-paced market, staying informed is crucial. Earnings calendars help investors stay ahead of the curve, ensuring they have access to the latest information and can react swiftly to market developments.

Types of Earnings Calendars

There are various types of earnings calendars available, each catering to specific needs:

1. General Earnings Calendars: These calendars list the earnings release dates for all publicly traded companies, providing a broad overview of market activity.

2. Sector-Specific Earnings Calendars: These calendars focus on specific industries, allowing investors to track earnings reports for companies within their desired sectors.

3. Company-Specific Earnings Calendars: These calendars provide detailed information about a specific company’s earnings release schedule, including historical data and analyst expectations.

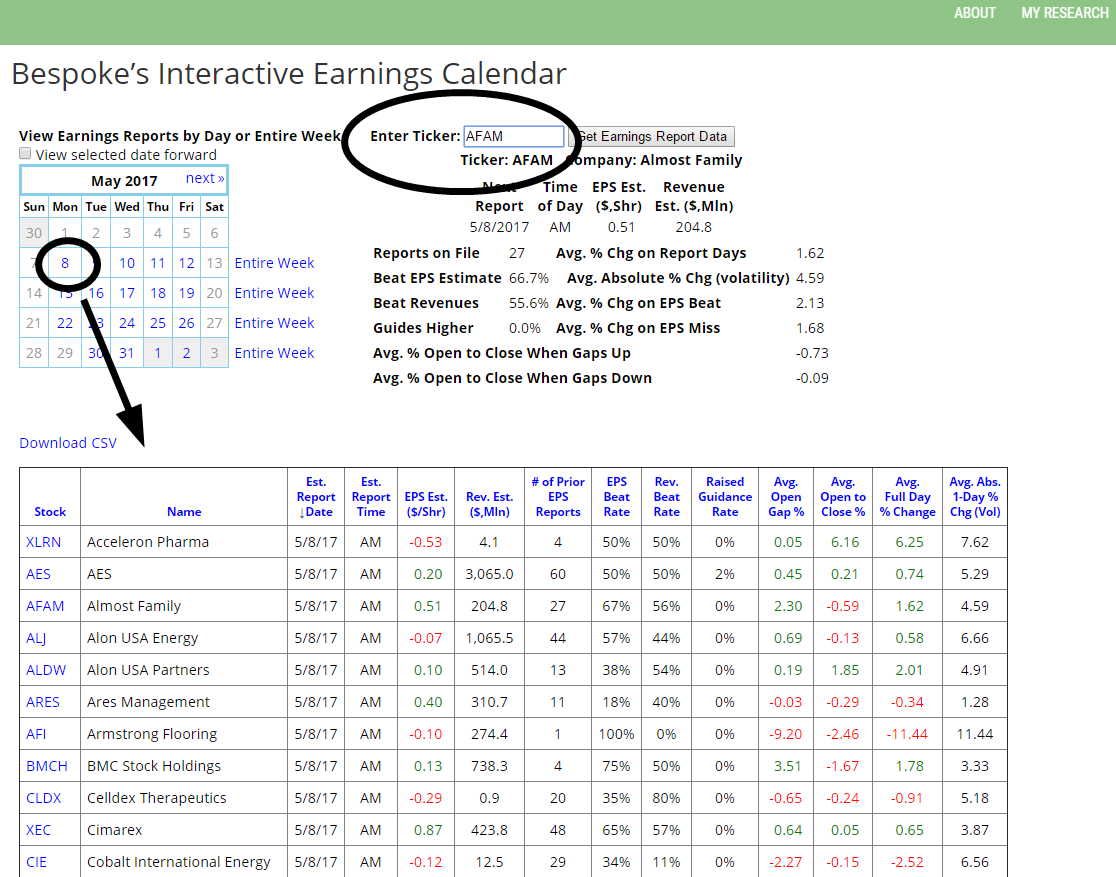

4. Interactive Earnings Calendars: These calendars offer dynamic features like real-time updates, customizable filters, and integrated news feeds, providing a comprehensive and interactive experience for investors.

How to Use an Earnings Calendar Effectively

While earnings calendars are valuable tools, it’s crucial to use them effectively to maximize their benefits:

1. Understand the Calendar’s Scope: Ensure you understand the calendar’s coverage, including the time frame, the types of companies listed, and any specific filters applied.

2. Analyze Earnings Reports: Don’t rely solely on the earnings calendar. Analyze the actual earnings reports to gain a deeper understanding of the company’s performance and outlook.

3. Consider Analyst Expectations: Compare the reported earnings to analyst expectations. A company exceeding expectations could lead to a stock price surge, while a miss might result in a decline.

4. Monitor Market Reactions: Observe how the market reacts to earnings releases. A positive reaction might signal a buying opportunity, while a negative reaction could indicate a potential sell-off.

5. Stay Updated: The market is dynamic, and earnings calendars can change quickly. Regularly update your information to ensure you have the latest data.

FAQs About Earnings Calendars

1. Where can I find an earnings calendar?

Numerous online resources provide earnings calendars, including financial websites like Yahoo Finance, Google Finance, and MarketWatch, as well as dedicated financial data providers like Refinitiv and Bloomberg.

2. How often are earnings calendars updated?

Earnings calendars are typically updated daily or even more frequently to reflect changes in earnings release dates.

3. Are earnings calendars always accurate?

While earnings calendars strive for accuracy, they are based on publicly available information and can be subject to changes. It’s essential to verify the information with the company’s official website or financial news sources.

4. How can I filter an earnings calendar?

Many earnings calendars offer filtering options, allowing you to customize your view based on factors like industry, company size, or date range.

5. Are earnings calendars free?

Most general earnings calendars are free to access, while some specialized calendars or those offering advanced features might require a subscription.

Tips for Utilizing Earnings Calendars

1. Set Reminders: Use the calendar’s notification features or set reminders in your preferred calendar app to stay informed about upcoming earnings releases.

2. Develop a Strategy: Determine your investment goals and risk tolerance. Use the calendar to identify opportunities that align with your strategy.

3. Analyze Historical Data: Review past earnings reports to understand a company’s historical performance and identify any recurring patterns or trends.

4. Consider Market Sentiment: Analyze market sentiment surrounding a company’s earnings release. Positive sentiment could lead to a price increase, while negative sentiment might result in a decline.

5. Stay Informed: Keep up-to-date with financial news and market developments to gain a comprehensive understanding of the context surrounding earnings releases.

Conclusion

Earnings calendars are essential tools for investors navigating the dynamic stock market. By providing a comprehensive overview of earnings release dates, these calendars allow investors to stay informed, make informed decisions, and potentially capitalize on market opportunities. By understanding the importance, types, and effective utilization of earnings calendars, investors can gain a valuable edge in their investment journey. However, remember that these calendars are merely a starting point. Thorough research, careful analysis, and a well-defined investment strategy are crucial for success in the market.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Market with Earnings Reports: A Guide to Understanding and Utilizing Earnings Calendars. We appreciate your attention to our article. See you in our next article!