Navigating The Oil Market: A Comprehensive Guide To The Oil Calendar

Navigating the Oil Market: A Comprehensive Guide to the Oil Calendar

Related Articles: Navigating the Oil Market: A Comprehensive Guide to the Oil Calendar

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Oil Market: A Comprehensive Guide to the Oil Calendar. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Oil Market: A Comprehensive Guide to the Oil Calendar

The oil market, a complex and dynamic ecosystem, is governed by a myriad of factors that influence its ebb and flow. Among these, the oil calendar stands as a critical tool for understanding the rhythm of the industry, providing insights into key events and their potential impact on oil prices.

This comprehensive guide delves into the intricacies of the oil calendar, exploring its significance, key events, and how it can be leveraged for informed decision-making.

Understanding the Oil Calendar: A Roadmap to Market Movements

The oil calendar, essentially a timeline of significant events and reports impacting the oil market, serves as a roadmap for navigating the complexities of this dynamic industry. It provides a structured framework for understanding the cyclical nature of oil prices and the factors that drive them.

Key Events and Reports: The Pillars of the Oil Calendar

The oil calendar is populated with a series of crucial events and reports that exert considerable influence on oil prices. These events, ranging from OPEC meetings to inventory data releases, provide valuable insights into supply and demand dynamics, impacting market sentiment and price fluctuations.

OPEC Meetings: Shaping Global Oil Production

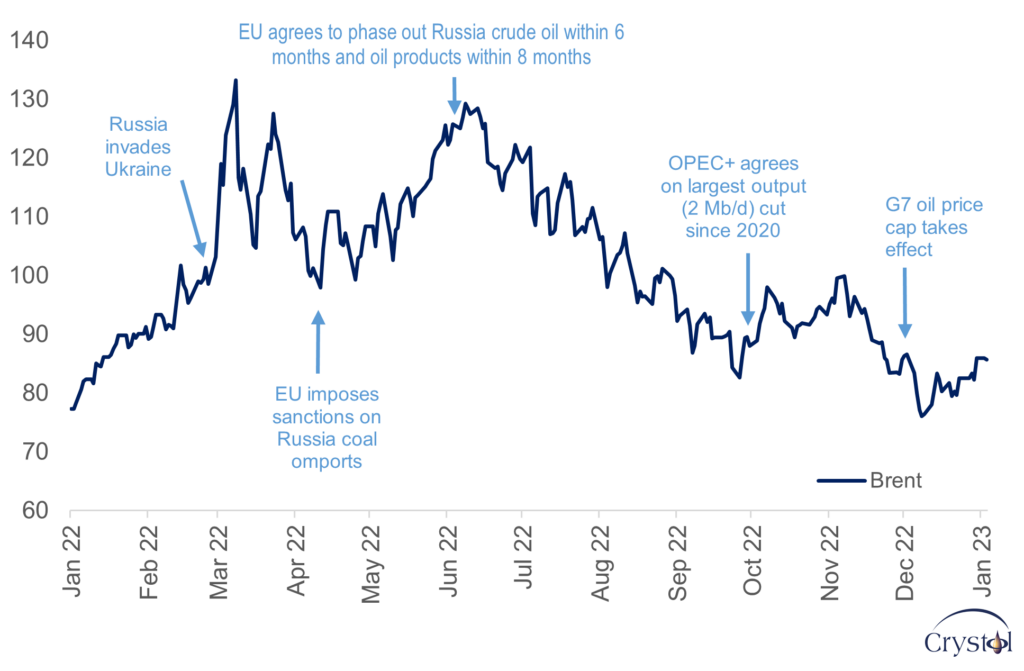

The Organization of the Petroleum Exporting Countries (OPEC), a cartel of oil-producing nations, plays a pivotal role in shaping global oil production and influencing prices. OPEC meetings, where member countries discuss production quotas and strategies, are closely watched by market participants, as their decisions can significantly impact oil supply and price trends.

Inventory Data Releases: Gauging Oil Supply and Demand

Regularly released inventory data, such as the American Petroleum Institute (API) and the Energy Information Administration (EIA) reports, provide crucial insights into oil supply and demand dynamics. These reports reveal changes in crude oil and product inventories, offering valuable clues about the health of the market and potential price movements.

Demand Forecasts: Anticipating Future Consumption

Demand forecasts, such as those released by the International Energy Agency (IEA), provide insights into future oil consumption patterns. These projections offer a glimpse into the expected demand for oil, influencing market expectations and potentially impacting prices.

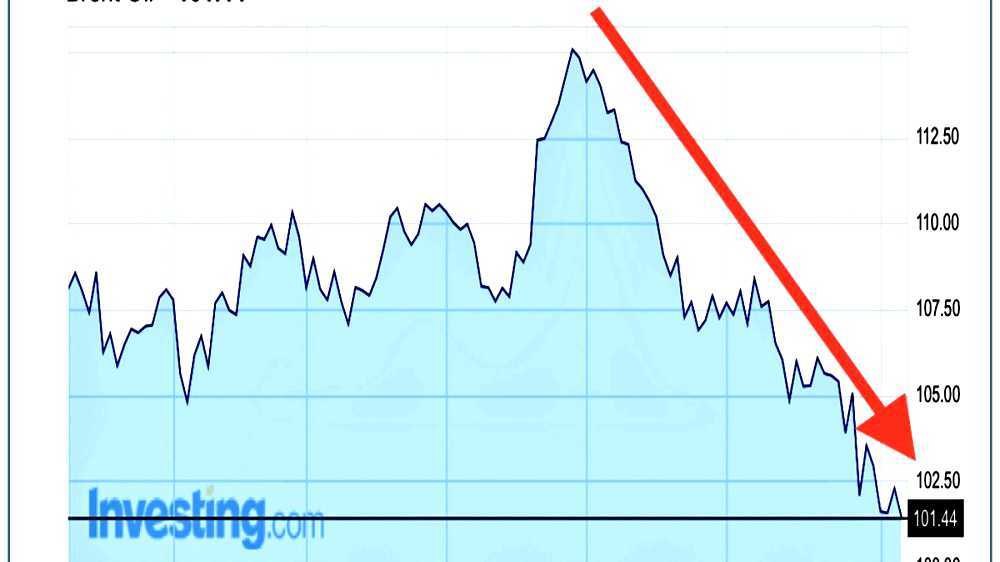

Geopolitical Events: Unpredictable Influences on the Oil Market

Geopolitical events, such as wars, sanctions, and political instability in oil-producing regions, can significantly disrupt oil supply and influence prices. These events often lead to uncertainty and volatility in the market, making it crucial to monitor them closely.

Economic Indicators: Reflecting Global Demand

Economic indicators, such as GDP growth, inflation, and interest rates, provide insights into global economic health and consumer spending patterns. These indicators can influence oil demand and, consequently, oil prices.

Using the Oil Calendar for Informed Decision-Making

The oil calendar serves as a powerful tool for informed decision-making in the oil market. By understanding the significance of key events and reports, market participants can:

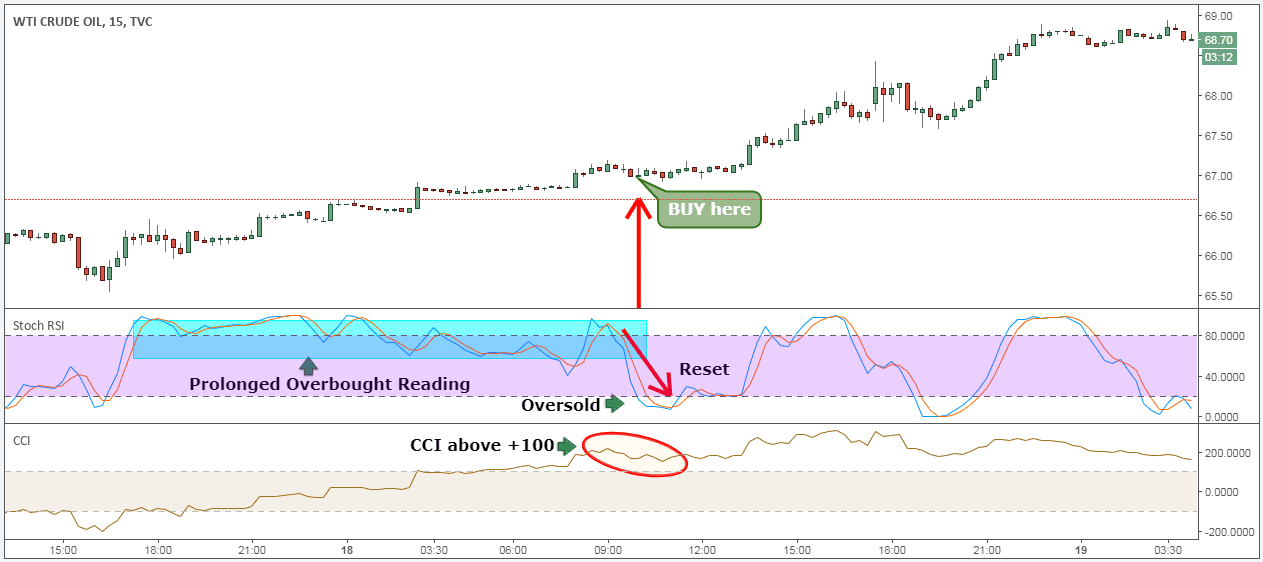

- Anticipate Price Movements: Understanding the potential impact of upcoming events and reports can help investors anticipate price movements and make informed trading decisions.

- Identify Investment Opportunities: By monitoring the oil calendar, investors can identify potential investment opportunities based on anticipated price fluctuations.

- Manage Risk: By understanding the risks associated with upcoming events and reports, investors can develop strategies to mitigate potential losses.

FAQs about the Oil Calendar

Q: What is the significance of the oil calendar?

A: The oil calendar provides a structured framework for understanding the factors that drive oil prices, enabling investors to make informed decisions.

Q: What are the key events and reports to watch on the oil calendar?

A: Key events include OPEC meetings, inventory data releases, demand forecasts, geopolitical events, and economic indicators.

Q: How can the oil calendar be used for informed decision-making?

A: By understanding the potential impact of upcoming events, investors can anticipate price movements, identify investment opportunities, and manage risk.

Tips for Using the Oil Calendar Effectively

- Stay Informed: Regularly monitor the oil calendar and subscribe to relevant news sources to stay updated on upcoming events.

- Analyze Data: Carefully analyze data released in reports, such as inventory data and demand forecasts, to gain a comprehensive understanding of market dynamics.

- Consider Geopolitical Factors: Pay close attention to geopolitical events that could disrupt oil supply and influence prices.

- Monitor Economic Indicators: Track economic indicators to gauge global demand and its impact on oil prices.

- Develop a Trading Strategy: Based on your understanding of the oil calendar and market dynamics, develop a trading strategy that aligns with your investment goals and risk tolerance.

Conclusion

The oil calendar serves as an indispensable tool for navigating the complex and dynamic oil market. By understanding the significance of key events and reports, investors can make informed decisions, anticipate price movements, identify investment opportunities, and manage risk effectively. As a dynamic and ever-evolving tool, the oil calendar remains a vital resource for anyone seeking to navigate the intricacies of the oil market.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Oil Market: A Comprehensive Guide to the Oil Calendar. We hope you find this article informative and beneficial. See you in our next article!