Navigating The OSUP Payroll Calendar: A Comprehensive Guide For Employees

Navigating the OSUP Payroll Calendar: A Comprehensive Guide for Employees

Related Articles: Navigating the OSUP Payroll Calendar: A Comprehensive Guide for Employees

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the OSUP Payroll Calendar: A Comprehensive Guide for Employees. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the OSUP Payroll Calendar: A Comprehensive Guide for Employees

The Ohio State University (OSU) Payroll Calendar is an essential tool for employees, providing clarity and consistency regarding salary payments and other financial matters. This comprehensive guide will delve into the intricacies of the OSUP payroll calendar, offering insights into its structure, key dates, and the benefits it provides to both employees and the university itself.

Understanding the Structure of the OSUP Payroll Calendar

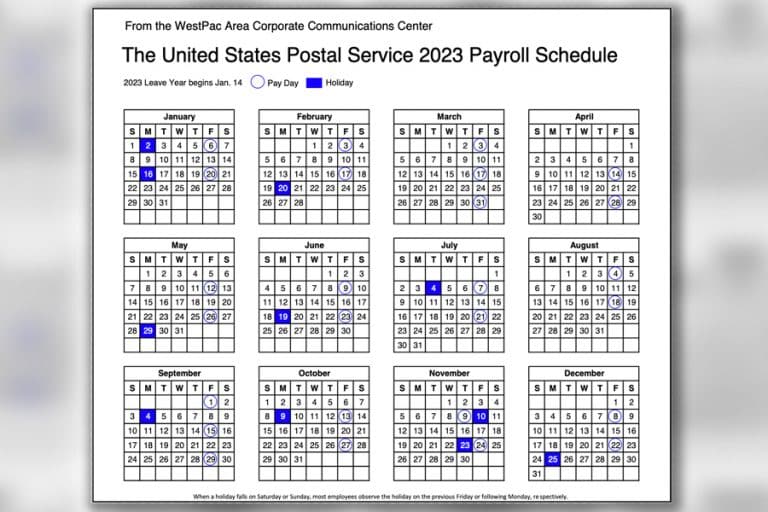

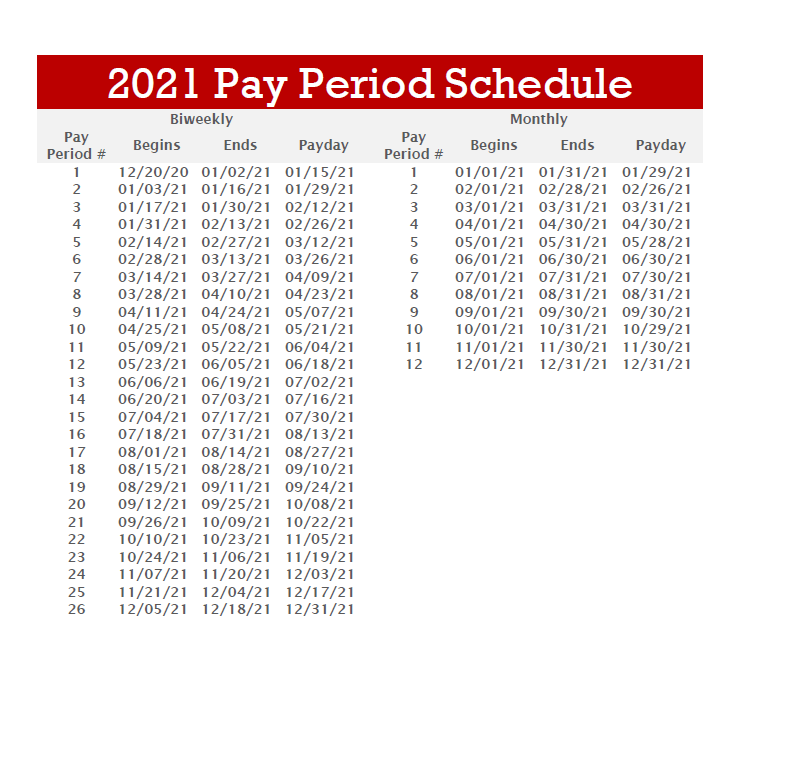

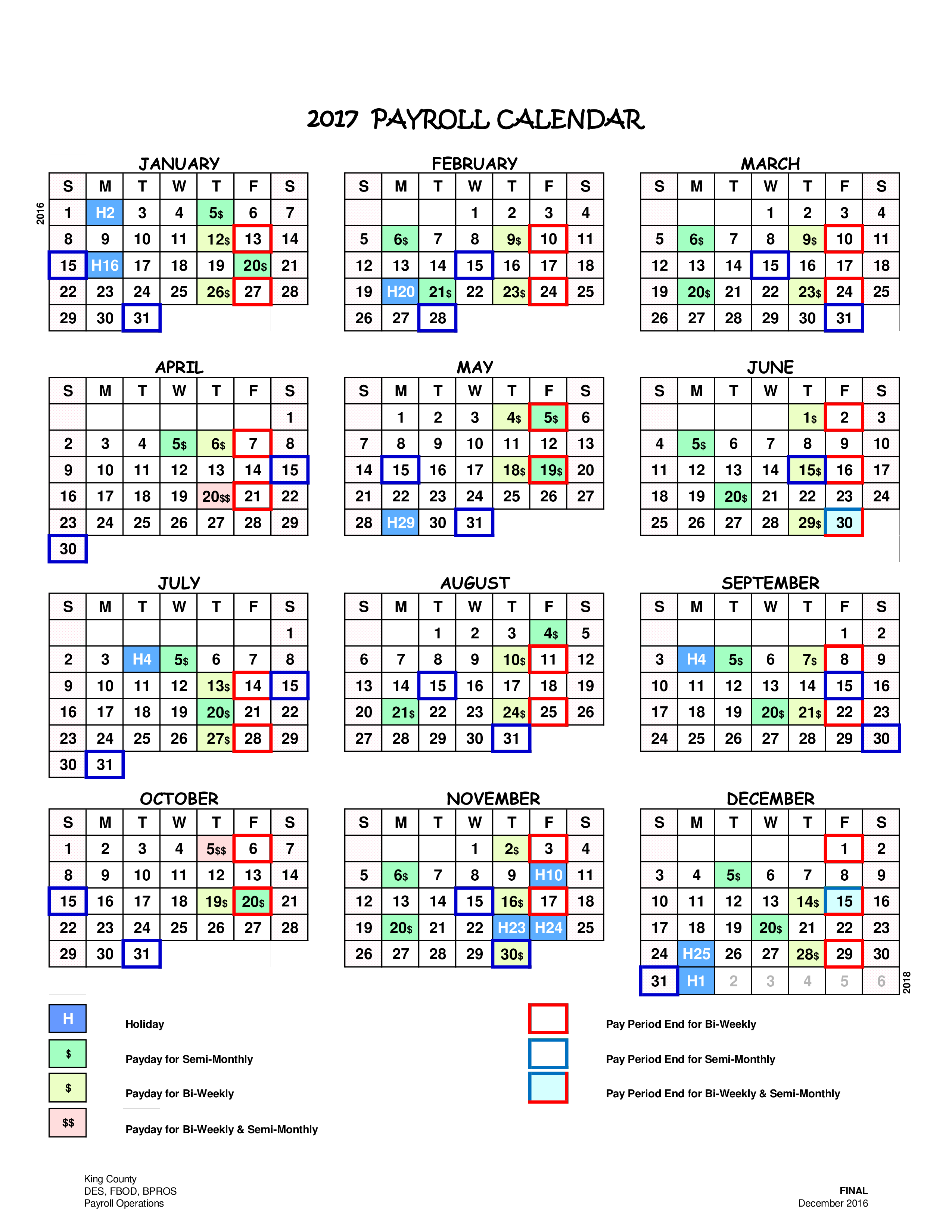

The OSUP payroll calendar operates on a bi-weekly schedule, with paydays occurring every other Friday. This consistent rhythm allows employees to anticipate their income and plan their finances accordingly. The calendar is meticulously crafted to align with university holidays and other important dates, ensuring that payroll processing runs smoothly.

Key Dates and Their Significance

The OSUP payroll calendar features several key dates that are vital for employees to understand. These include:

- Paydays: These are the dates when employees receive their salaries. The calendar clearly outlines the paydays for each bi-weekly period throughout the year.

- Payroll Cutoffs: These are the deadlines for submitting time and attendance information, as well as any necessary changes to payroll deductions. Failure to meet these deadlines may result in delays in receiving payment.

- Holiday Pay: The calendar clearly indicates the holidays observed by the university, which may affect payroll. For instance, employees may receive holiday pay for days they do not work, or their paydays may be adjusted due to holiday closures.

- Tax Filing Deadlines: The calendar may also include important tax-related deadlines, such as the deadline for filing federal and state income taxes.

The Benefits of a Well-Defined Payroll Calendar

A clear and accessible payroll calendar offers numerous benefits for both employees and the university:

For Employees:

- Financial Planning: The predictable paydays allow employees to budget effectively and manage their personal finances with greater ease.

- Time Management: The payroll cutoffs provide employees with clear deadlines for submitting their time and attendance information, ensuring timely processing of their pay.

- Transparency and Clarity: The calendar provides transparency into the university’s payroll system, fostering trust and understanding among employees.

- Reduced Stress: Knowing when to expect their paychecks and understanding the payroll process reduces stress and anxiety for employees.

For the University:

- Operational Efficiency: A well-defined payroll calendar streamlines payroll processing, ensuring timely and accurate payments to employees.

- Compliance with Regulations: The calendar helps the university comply with all relevant payroll regulations, minimizing the risk of legal issues.

- Employee Satisfaction: A transparent and reliable payroll system contributes to employee satisfaction, boosting morale and productivity.

- Financial Stability: The calendar plays a crucial role in maintaining the university’s financial stability by ensuring timely payments to employees.

Navigating the OSUP Payroll Calendar: Resources and Information

The OSUP payroll calendar is readily accessible to all employees through various channels:

- University Website: The university website typically hosts a dedicated section for payroll information, including the current payroll calendar and relevant FAQs.

- Employee Handbook: The employee handbook often includes details about the payroll calendar and related procedures.

- Human Resources Department: The HR department is a valuable resource for employees seeking clarification on any aspect of the payroll calendar.

FAQs Regarding the OSUP Payroll Calendar

1. What happens if I miss the payroll cutoff deadline?

Missing the payroll cutoff deadline may result in a delay in receiving your payment. It is crucial to submit your time and attendance information, as well as any necessary changes to your payroll deductions, before the deadline.

2. How can I access the OSUP payroll calendar?

The payroll calendar is typically available on the university website’s payroll information section. You can also consult your employee handbook or contact the HR department for assistance.

3. What if a payday falls on a holiday?

If a payday falls on a holiday, your paycheck may be issued on the preceding business day. The payroll calendar will clearly indicate any adjustments to the pay schedule due to holidays.

4. How do I make changes to my payroll deductions?

To make changes to your payroll deductions, you will need to contact the HR department. They will guide you through the necessary procedures and ensure that your changes are processed correctly.

5. Where can I find information about my pay stubs?

Your pay stubs are typically available through the university’s online payroll system. You can access this system using your employee credentials.

Tips for Effective Utilization of the OSUP Payroll Calendar

- Bookmark the Payroll Calendar: Save the link to the payroll calendar on your computer or mobile device for easy access.

- Set Reminders: Utilize calendar apps or reminders to ensure you meet payroll cutoffs and other important deadlines.

- Stay Informed: Regularly check the payroll calendar for any updates or changes to the schedule.

- Contact HR for Assistance: If you have any questions or concerns about the payroll calendar, don’t hesitate to contact the HR department for assistance.

Conclusion

The OSUP payroll calendar is a vital tool for employees, providing clarity and consistency regarding their salary payments. By understanding the calendar’s structure, key dates, and benefits, employees can effectively manage their finances, plan their time, and contribute to the smooth operation of the university. The calendar promotes transparency, reduces stress, and fosters a sense of trust and understanding between employees and the university. By utilizing the resources available and staying informed, employees can maximize the benefits of the OSUP payroll calendar and ensure a seamless payroll experience.

Closure

Thus, we hope this article has provided valuable insights into Navigating the OSUP Payroll Calendar: A Comprehensive Guide for Employees. We thank you for taking the time to read this article. See you in our next article!