Understanding The July To July Calendar: A Comprehensive Guide

Understanding the July to July Calendar: A Comprehensive Guide

Related Articles: Understanding the July to July Calendar: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Understanding the July to July Calendar: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the July to July Calendar: A Comprehensive Guide

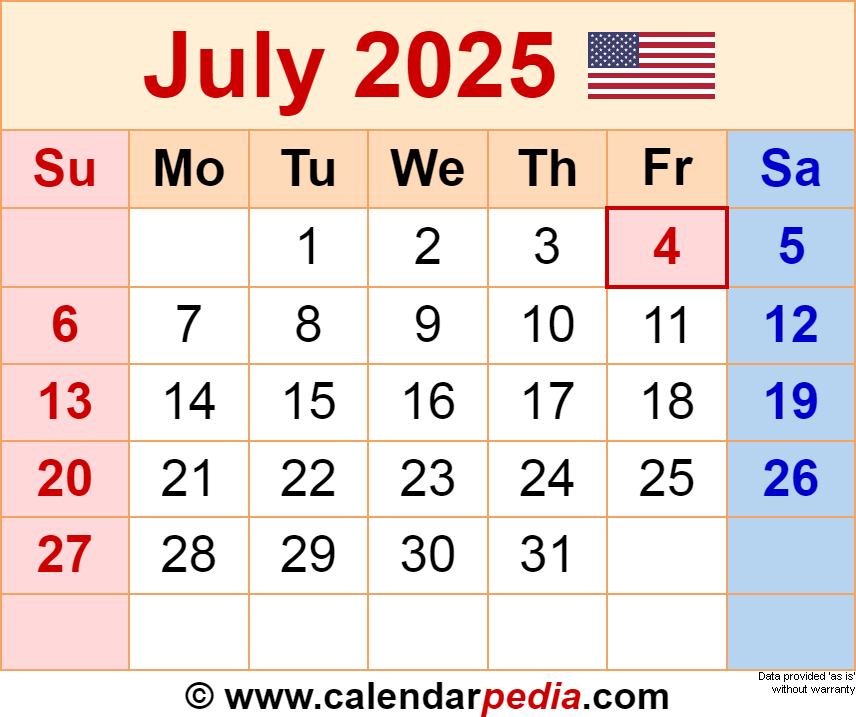

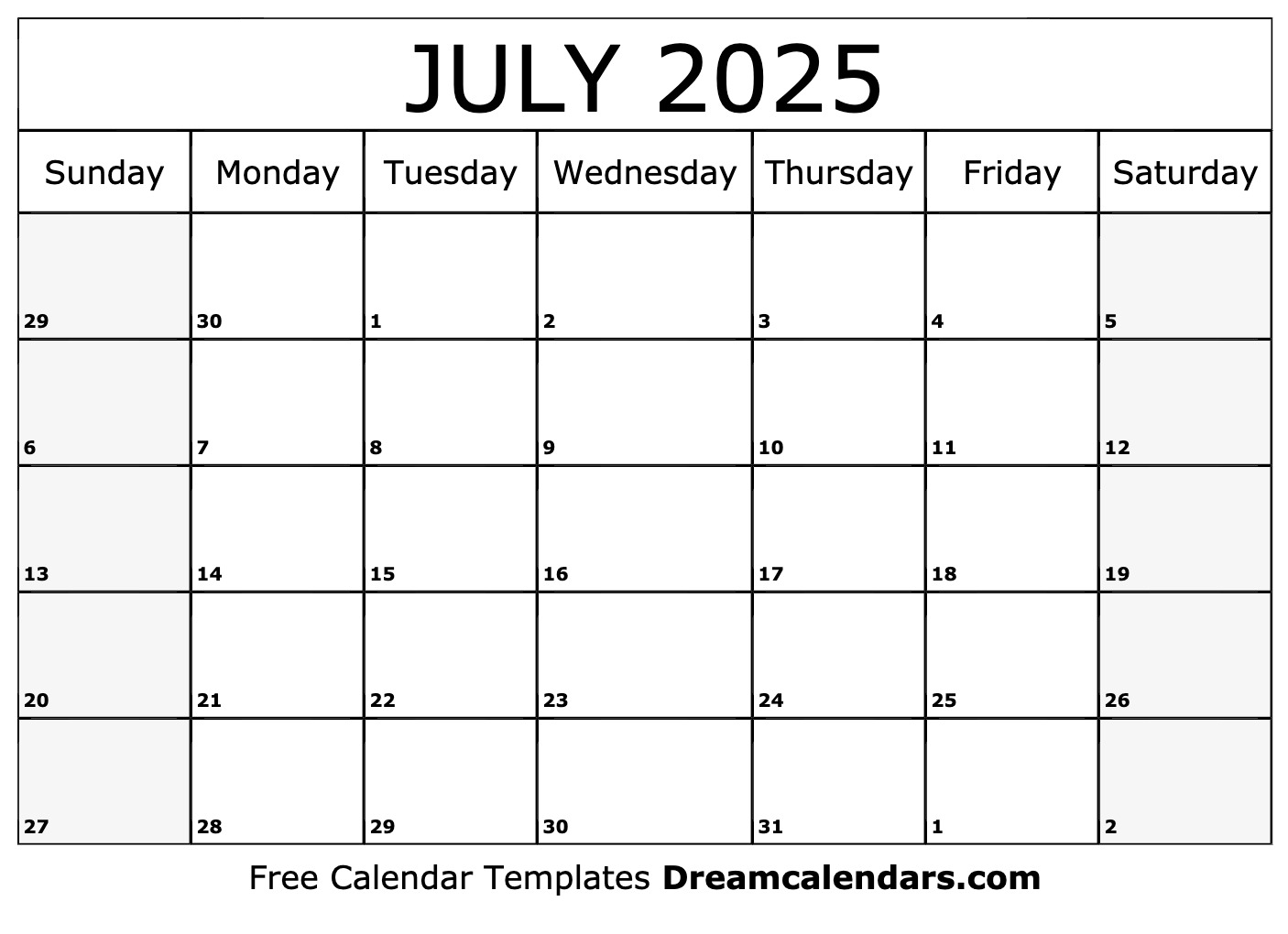

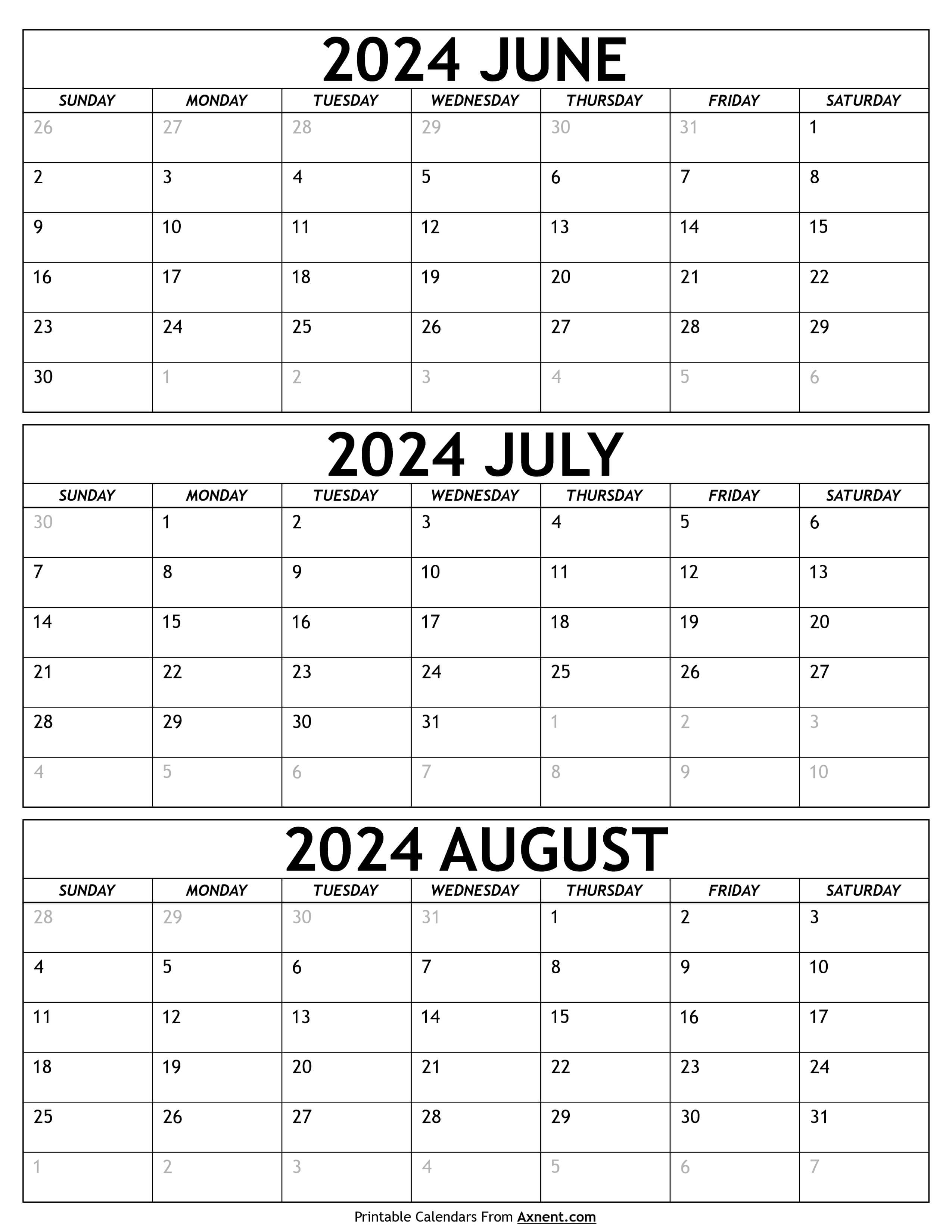

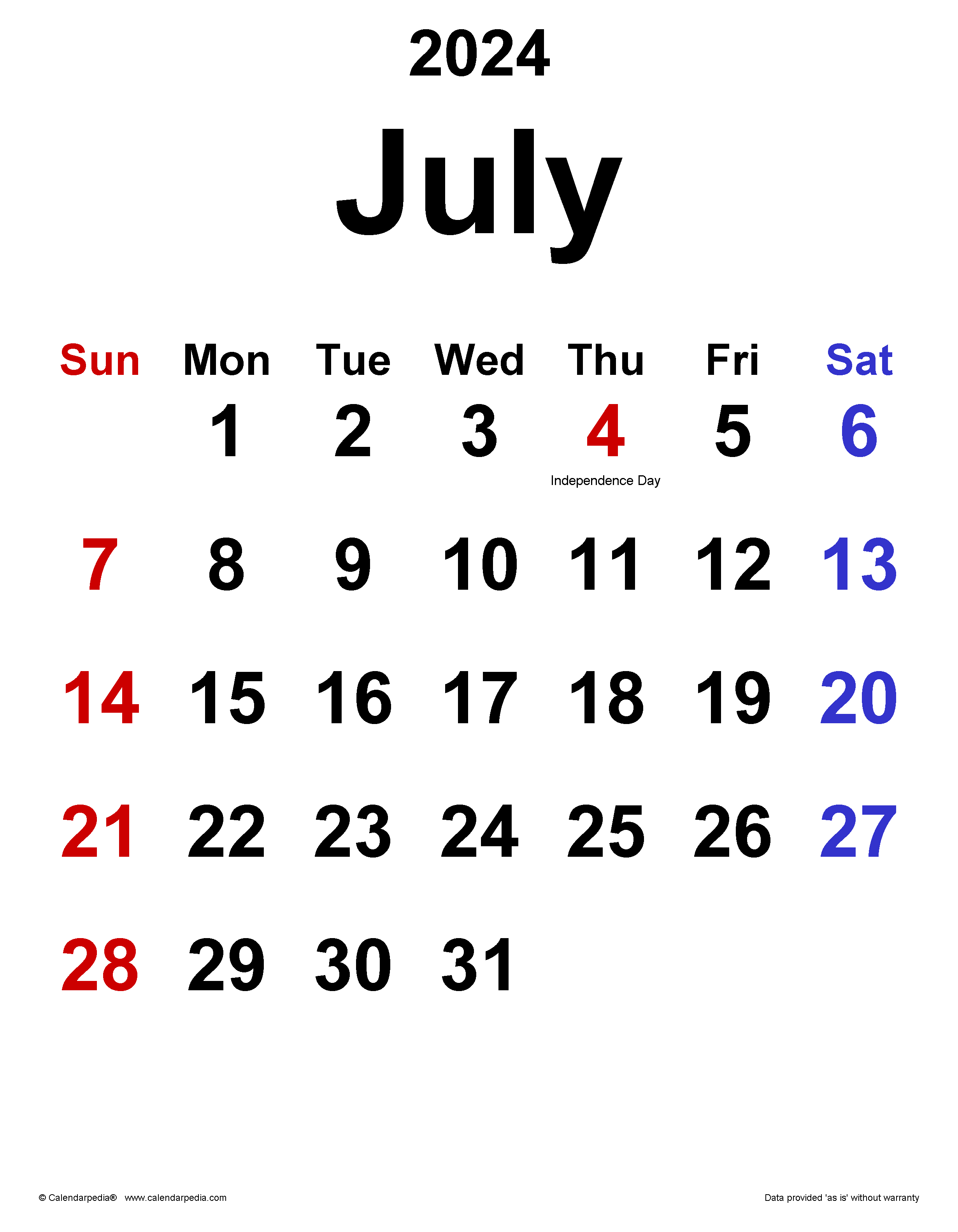

The concept of a "July to July calendar" might seem unconventional, but it offers a unique and valuable perspective for various aspects of life, particularly in the context of financial planning, budgeting, and personal development. This article aims to provide a comprehensive understanding of this calendar, its significance, and its potential benefits.

What is a July to July Calendar?

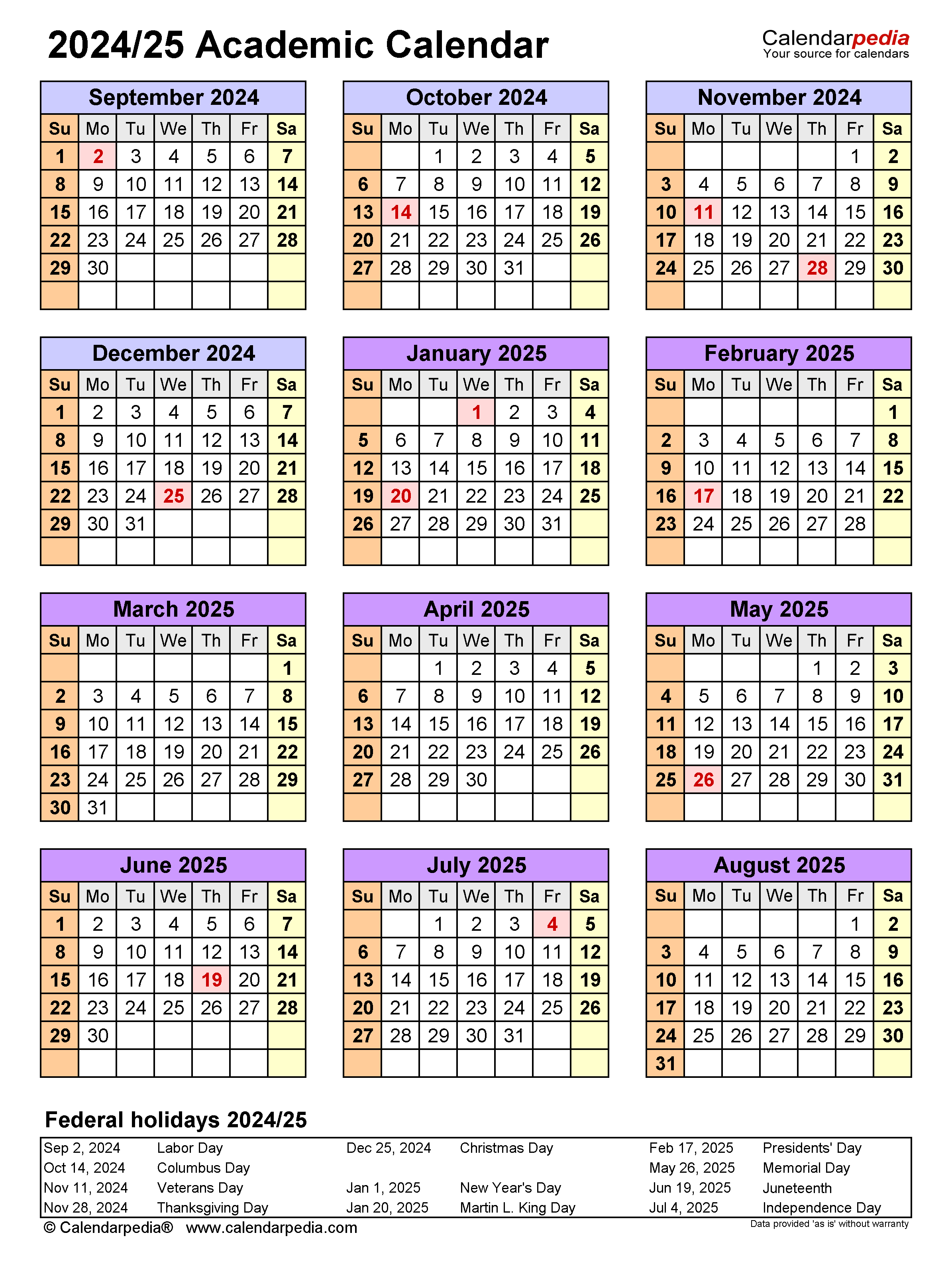

A July to July calendar is a system that utilizes the period between July 1st of one year and July 1st of the following year as a financial or planning cycle. This approach deviates from the traditional calendar year (January to December) and offers several distinct advantages, particularly for individuals and businesses involved in seasonal industries or those aiming for more flexible budgeting strategies.

Why Choose a July to July Calendar?

The July to July calendar offers several key benefits:

- Alignment with Seasonal Cycles: Many industries, such as agriculture, tourism, and retail, experience cyclical patterns closely aligned with the calendar year. A July to July calendar allows for a more natural integration of financial planning with these seasonal fluctuations.

- Flexibility in Budgeting: By starting the financial year in July, individuals and businesses can better align their spending and income with seasonal income patterns. This flexibility can be particularly beneficial for those with irregular income streams or those who experience significant seasonal expenses.

- Improved Goal Setting: A July to July calendar provides a unique opportunity to set and track progress on personal or professional goals aligned with the natural rhythm of the year. It allows for a more holistic view of achievements, considering both short-term and long-term objectives.

- Enhanced Financial Visibility: By focusing on a July to July cycle, individuals and businesses gain a clearer picture of their financial performance throughout the year. This enhanced visibility can lead to more informed decision-making and improved financial management.

Practical Applications of the July to July Calendar

The July to July calendar can be effectively applied in various contexts:

- Personal Finance: Individuals can utilize this calendar to track their income and expenses, budget for seasonal spending patterns, and set financial goals aligned with their personal needs and aspirations.

- Business Planning: Businesses, particularly those operating in seasonal industries, can use this calendar to plan their marketing campaigns, inventory management, and staffing needs based on the anticipated demand fluctuations throughout the year.

- Project Management: Projects with defined start and end dates can be effectively managed within a July to July framework, facilitating progress tracking and resource allocation based on the specific project timeline.

- Personal Development: Individuals can utilize this calendar to set personal goals, track their progress, and reflect on their achievements throughout the year, fostering a sense of continuous improvement and personal growth.

FAQ Regarding July to July Calendar

Q: How does a July to July calendar affect tax filing?

A: The tax year remains unchanged, regardless of the calendar used for financial planning. Taxes are still filed based on the traditional January to December calendar year.

Q: Can a July to July calendar be used for any type of business?

A: While beneficial for seasonal businesses, the July to July calendar can be adapted for any business. It provides a framework for financial planning and budgeting, allowing for greater flexibility and alignment with business goals.

Q: How do I transition to a July to July calendar?

A: The transition can be gradual. Start by tracking your income and expenses for the period between July 1st and December 31st. Then, adjust your budget to reflect the full July to July cycle.

Tips for Implementing a July to July Calendar

- Start with a Clear Goal: Define your objectives for using the July to July calendar. Whether it’s for improved financial management, personal development, or business planning, having a clear goal will guide your implementation.

- Track Your Progress: Regularly monitor your income, expenses, and achievements within the July to July cycle. This will help you identify areas for improvement and ensure you stay on track with your goals.

- Adapt to Your Needs: The July to July calendar is a framework, not a rigid rule. Adjust it to accommodate your specific needs and circumstances, ensuring it effectively serves your objectives.

- Seek Professional Advice: If you’re unsure about implementing a July to July calendar or need assistance with financial planning, consider consulting with a financial advisor or business consultant.

Conclusion

The July to July calendar offers a unique and beneficial approach to financial planning, budgeting, and personal development. By aligning with natural cycles and providing greater flexibility, it empowers individuals and businesses to achieve their goals more effectively. While it might require an initial adjustment, the potential benefits of a July to July calendar make it a worthwhile consideration for anyone seeking to optimize their financial management and personal growth.

Closure

Thus, we hope this article has provided valuable insights into Understanding the July to July Calendar: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!