Understanding The Significance Of The Insurance Calendar Year

Understanding the Significance of the Insurance Calendar Year

Related Articles: Understanding the Significance of the Insurance Calendar Year

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Understanding the Significance of the Insurance Calendar Year. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Understanding the Significance of the Insurance Calendar Year

- 2 Introduction

- 3 Understanding the Significance of the Insurance Calendar Year

- 3.1 Defining the Insurance Calendar Year

- 3.2 The Significance of the Insurance Calendar Year

- 3.3 Benefits of the Insurance Calendar Year

- 3.4 FAQs on Insurance Calendar Year

- 3.5 Tips for Managing Your Insurance Policy within the Insurance Calendar Year

- 3.6 Conclusion

- 4 Closure

Understanding the Significance of the Insurance Calendar Year

The concept of an insurance calendar year, while seemingly straightforward, plays a crucial role in the intricate world of insurance. It establishes a standardized timeframe for various insurance-related activities, impacting policy renewals, premium calculations, and claims processing. This article delves into the nuances of the insurance calendar year, illuminating its importance and benefits for both policyholders and insurers.

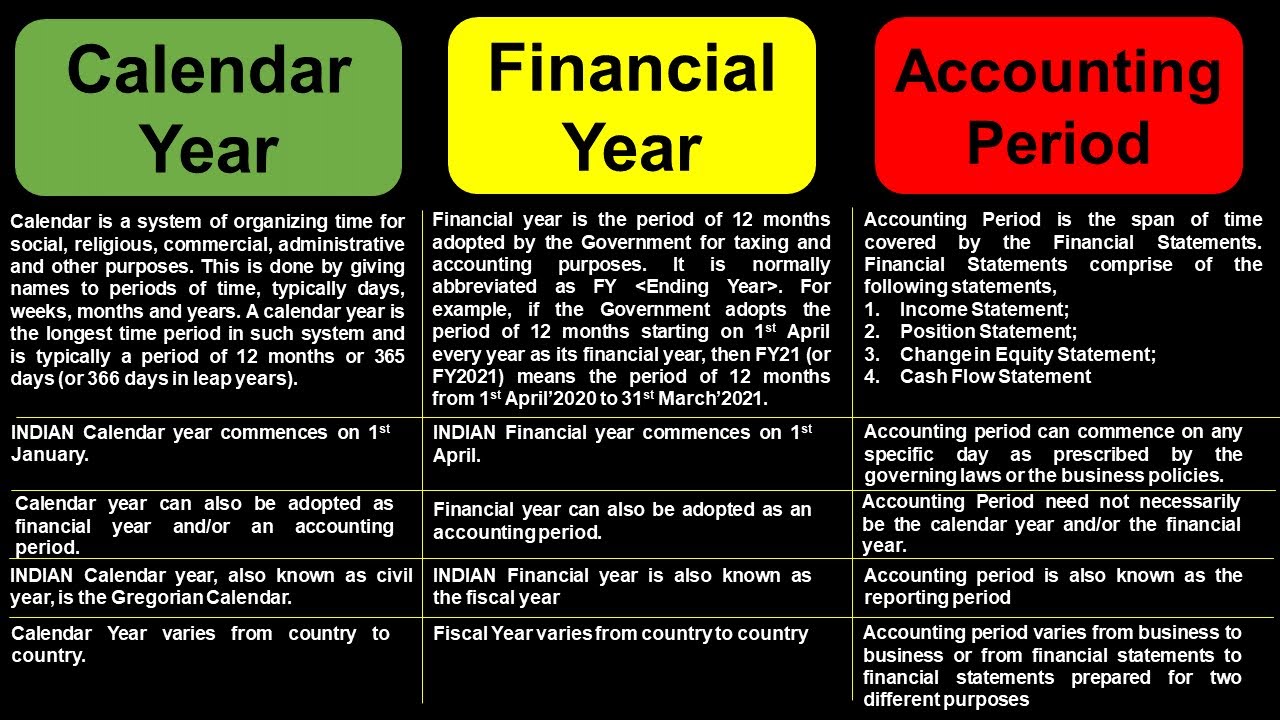

Defining the Insurance Calendar Year

The insurance calendar year, unlike the standard Gregorian calendar, does not follow the familiar January-to-December format. Instead, it typically runs from April 1st to March 31st of the following year. This specific timeframe has historical roots, stemming from the agricultural cycle and the need for insurance coverage during periods of peak activity.

The Significance of the Insurance Calendar Year

The insurance calendar year serves as a cornerstone for several key aspects of the insurance industry:

1. Policy Renewal and Premium Calculations:

- The insurance calendar year dictates the renewal date for most policies. Policyholders receive renewal notices a few weeks before their policy anniversary, which falls on the same date each year within the insurance calendar year.

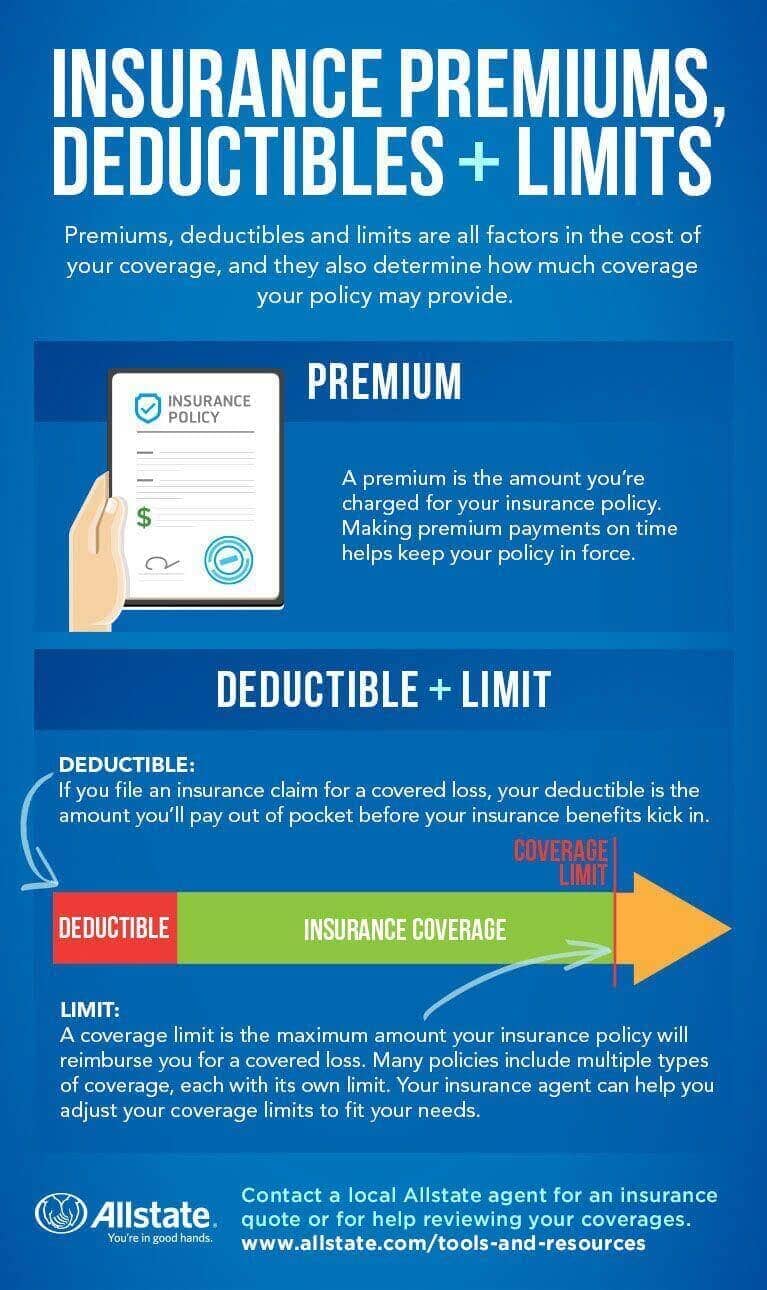

- Premiums are typically calculated based on the policyholder’s risk profile and coverage during the preceding insurance calendar year. This ensures that premiums accurately reflect the individual’s risk exposure over a specific period.

2. Claims Processing and Coverage:

- Claims are processed and settled according to the insurance calendar year in which they occur. This ensures consistency and clarity in managing claims across different policy periods.

- Coverage limits and deductibles are generally defined within the context of the insurance calendar year. This provides a clear framework for understanding the extent of coverage available to policyholders.

3. Financial Reporting and Analysis:

- Insurers utilize the insurance calendar year for financial reporting and analysis purposes. This allows them to track performance, assess profitability, and make informed decisions based on a consistent reporting period.

Benefits of the Insurance Calendar Year

The insurance calendar year offers several advantages:

1. Predictability and Consistency:

- The standardized timeframe fosters predictability for both policyholders and insurers. Policyholders can anticipate renewal dates and premium adjustments, while insurers can effectively manage their financial obligations and coverage commitments.

- Consistency in the application of the insurance calendar year across the industry ensures fairness and transparency in policy administration.

2. Streamlined Operations:

- The insurance calendar year facilitates efficient operations for insurers, allowing them to manage claims, process renewals, and generate reports within a defined timeframe.

- This streamlined approach minimizes administrative complexity and improves overall operational efficiency.

3. Accurate Risk Assessment:

- By aligning premium calculations with the insurance calendar year, insurers can accurately assess the risk profile of policyholders based on their exposure over a specific period. This allows for more equitable premium pricing and a fair allocation of risk.

FAQs on Insurance Calendar Year

Q: What happens if I purchase a policy mid-year?

A: If you purchase a policy mid-year, your policy period will still align with the insurance calendar year. You will pay a prorated premium for the remaining period within the current insurance calendar year and your next renewal date will fall on the same date within the following insurance calendar year.

Q: Does the insurance calendar year affect my coverage?

A: Yes, your coverage limits and deductibles are generally defined within the context of the insurance calendar year. This means that your coverage may differ depending on when your policy period falls within the insurance calendar year.

Q: How can I find out my policy anniversary date?

A: Your policy anniversary date is typically stated on your policy documents or renewal notices. You can also contact your insurance provider for confirmation.

Q: Can I change my policy anniversary date?

A: It is generally not possible to change your policy anniversary date. However, you can contact your insurance provider to discuss your options and explore potential alternatives.

Tips for Managing Your Insurance Policy within the Insurance Calendar Year

1. Track Your Policy Anniversary Date:

- Mark your policy anniversary date on your calendar to ensure timely renewal and avoid coverage gaps.

2. Review Your Coverage Needs:

- Before your renewal date, review your coverage needs to ensure they still align with your current circumstances. You may need to adjust your coverage levels or add additional endorsements.

3. Compare Quotes:

- Shop around for insurance quotes before your renewal date to compare prices and coverage options.

4. Communicate with Your Insurance Provider:

- If you have any questions or concerns about your policy, contact your insurance provider for clarification.

5. Keep Accurate Records:

- Maintain a record of your policy documents, renewal notices, and claims information for easy reference.

Conclusion

The insurance calendar year is a fundamental aspect of the insurance industry, providing a standardized framework for policy renewals, premium calculations, and claims processing. It fosters predictability, consistency, and efficient operations, ultimately benefiting both policyholders and insurers. By understanding the nuances of the insurance calendar year and following the provided tips, individuals can effectively manage their insurance policies and ensure they have adequate coverage throughout the year.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Significance of the Insurance Calendar Year. We hope you find this article informative and beneficial. See you in our next article!