Understanding The W-2 Calendar Year: A Guide For Employees And Employers

Understanding the W-2 Calendar Year: A Guide for Employees and Employers

Related Articles: Understanding the W-2 Calendar Year: A Guide for Employees and Employers

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Understanding the W-2 Calendar Year: A Guide for Employees and Employers. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the W-2 Calendar Year: A Guide for Employees and Employers

The concept of the calendar year is fundamental to many aspects of our lives, particularly when it comes to finances and employment. In the United States, the calendar year, specifically the "W-2 calendar year," plays a crucial role in determining tax obligations, payroll deductions, and employee benefits. This article aims to provide a comprehensive understanding of the W-2 calendar year, its significance for both employees and employers, and its implications for various aspects of the employment relationship.

Defining the W-2 Calendar Year:

The W-2 calendar year, in the context of employment, refers to the period between January 1st and December 31st of a given year. This timeframe is crucial for various reasons:

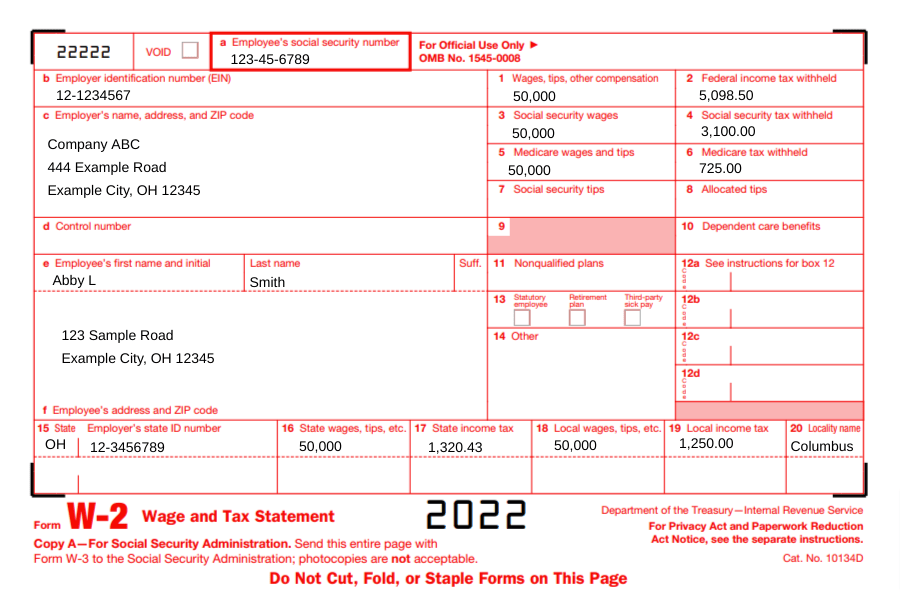

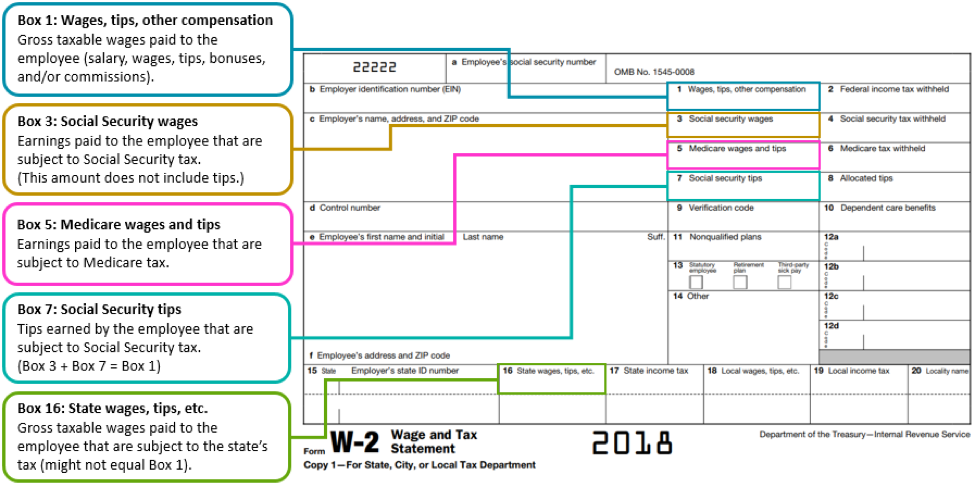

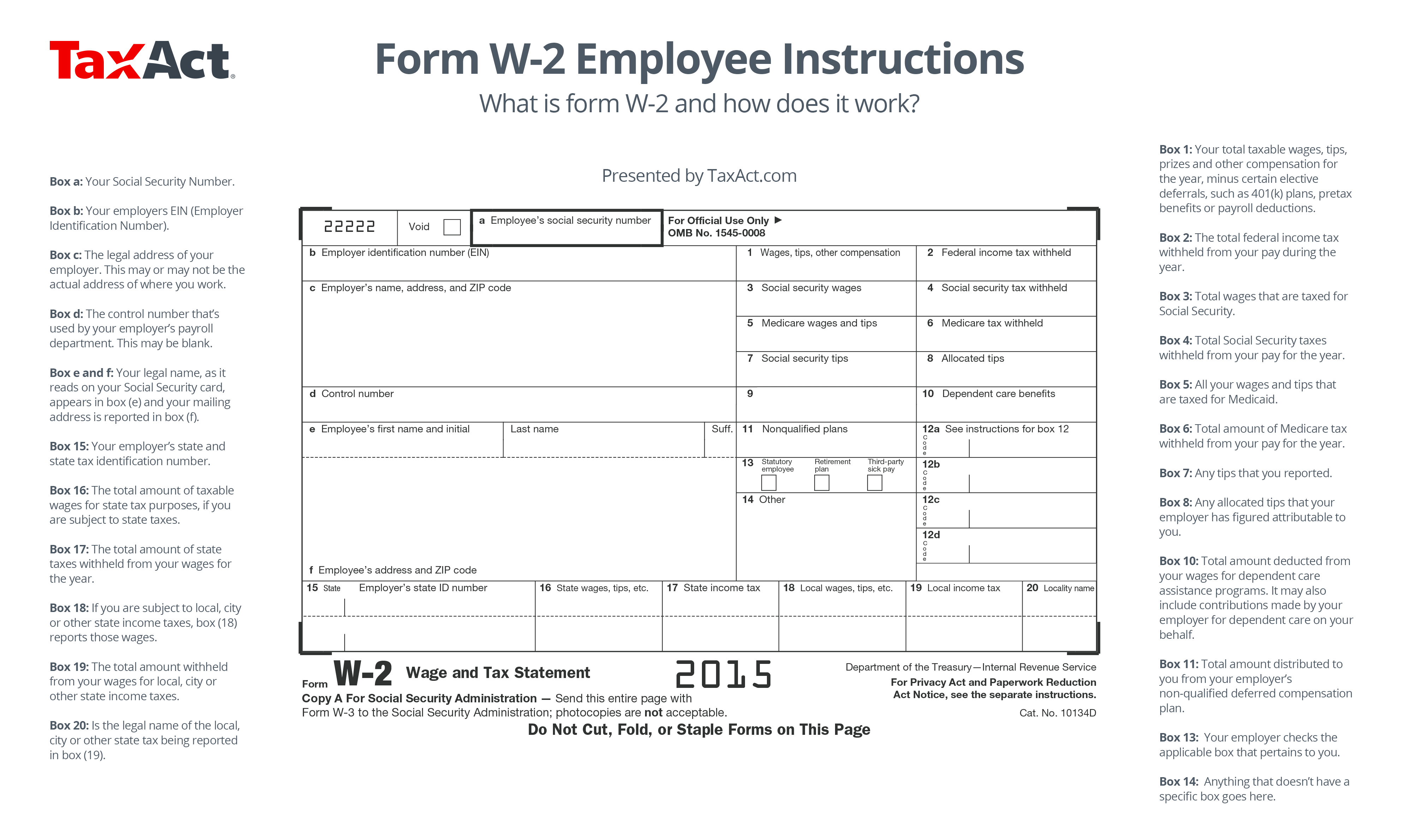

- Tax Reporting: The W-2 form, which details an employee’s earnings and tax withholdings, is issued annually for the preceding calendar year. This form is essential for filing federal and state income tax returns.

- Payroll Deductions: Payroll taxes, including Social Security, Medicare, and federal and state income taxes, are calculated and withheld based on the W-2 calendar year.

- Employee Benefits: Many employee benefits, such as health insurance, retirement plans, and paid time off, are administered on a calendar-year basis.

Significance for Employees:

For employees, understanding the W-2 calendar year is crucial for several reasons:

- Tax Planning: Knowing the W-2 calendar year allows employees to proactively plan for their tax obligations. This includes tracking income and expenses, making adjustments to withholdings, and maximizing deductions and credits.

- Benefit Management: Employees need to be aware of the calendar year to maximize their benefits. This includes understanding enrollment deadlines, benefit changes, and potential adjustments to contributions or deductions.

- Financial Planning: The W-2 calendar year provides a framework for financial planning. Employees can use this period to review their income and expenses, set financial goals, and make adjustments to their budget.

Significance for Employers:

For employers, the W-2 calendar year is equally important:

- Payroll Administration: Employers must adhere to the calendar year for payroll processing, tax withholdings, and reporting obligations. This includes issuing W-2 forms to employees, filing tax returns, and ensuring compliance with relevant laws and regulations.

- Benefit Administration: Employers need to manage employee benefits within the calendar year, including enrollment periods, contribution adjustments, and benefit changes. This requires careful planning and communication with employees.

- Financial Reporting: The calendar year provides a framework for financial reporting. Employers must track income, expenses, and payroll costs to ensure accuracy in their financial statements.

Implications for the Employment Relationship:

The W-2 calendar year significantly impacts the employment relationship:

- Compensation and Benefits: Wages, salaries, and benefits are typically calculated and paid based on the calendar year. This includes annual raises, bonuses, and other forms of compensation.

- Performance Reviews and Goals: Performance reviews, goal setting, and career development often align with the calendar year, providing a framework for employee evaluation and advancement.

- Employee Retention and Engagement: Understanding the W-2 calendar year allows employers to better manage employee retention and engagement. This includes providing timely and accurate information about benefits, compensation, and other aspects of the employment relationship.

Frequently Asked Questions:

Q: What happens if I start working in the middle of the year?

A: If you start working in the middle of the year, your employer will withhold taxes based on your projected income for the entire calendar year. You will receive a W-2 form at the end of the year that reflects your actual earnings for the portion of the year you worked.

Q: How does the calendar year affect my retirement contributions?

A: Many retirement plans operate on a calendar-year basis. You may have specific deadlines for contributions, withdrawals, or changes to your investment allocations.

Q: What are the implications of the calendar year for unemployment benefits?

A: Unemployment benefits are typically calculated based on your earnings in the previous calendar year.

Q: How do I ensure I’m maximizing my tax deductions?

A: Consult with a tax professional to understand available deductions and credits. Keep thorough records of income and expenses throughout the calendar year.

Tips for Employees:

- Track your income and expenses: Maintain accurate records of your earnings and deductions to maximize your tax benefits.

- Review your withholdings: Ensure your withholdings are appropriate based on your income and tax situation.

- Understand your benefits: Familiarize yourself with your employer-provided benefits and deadlines for enrollment or changes.

- Plan for the future: Use the calendar year as an opportunity to review your financial goals and make necessary adjustments.

Tips for Employers:

- Communicate clearly with employees: Provide timely and accurate information about payroll, benefits, and tax obligations.

- Stay compliant with regulations: Ensure your payroll and benefit administration practices comply with all relevant laws and regulations.

- Offer employee resources: Provide resources and support to help employees understand their tax obligations and benefit options.

- Plan for year-end activities: Prepare for year-end tax reporting, payroll adjustments, and benefit changes.

Conclusion:

The W-2 calendar year is an essential framework for understanding and managing the employment relationship. By understanding its implications for taxes, payroll, benefits, and financial planning, both employees and employers can navigate the complexities of employment and ensure a smooth and efficient experience. Proactive planning, accurate record-keeping, and clear communication are key to leveraging the calendar year to maximize benefits and minimize potential issues.

Closure

Thus, we hope this article has provided valuable insights into Understanding the W-2 Calendar Year: A Guide for Employees and Employers. We appreciate your attention to our article. See you in our next article!